New Delhi — Demand for plastics processing machinery in India is expected to grow 34 percent in the next four years, yielding an estimated $14 billion in investments, according to interviews and a report presented at Plastindia 2023.

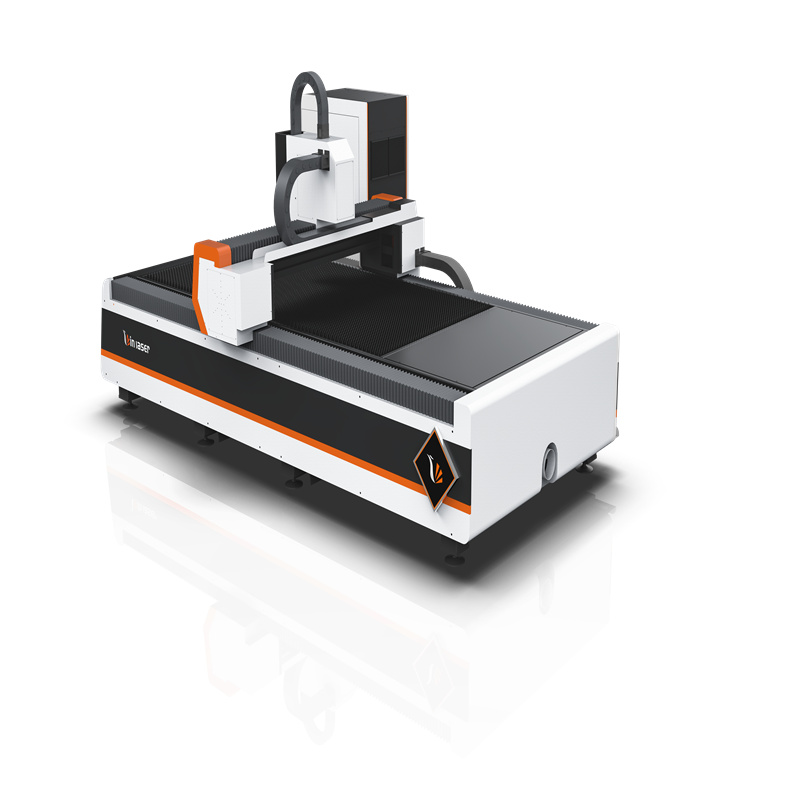

Plastics machinery executives at the show, held Feb. 1-5 in New Delhi, pointed to a number of factors, including a government focus on Make-in-India programs as well as free trade and comprehensive economic partnership agreements with other countries. Automatic Tube Cutting Machine

Tushar Parikh, vice chairman of the Plastic Machinery Manufacturers Association of India, also mentioned favorable developments in the government's recent budget.

"The government announced promotional schemes for exports and subsidies for acquiring new technology to upgrade production facilities for the MSME sector," he said, referring to micro, small and medium enterprises that account for 68 percent of machinery exhibitors at the trade fair.

Some major European companies are now scouting Indian partners in the MSME sector.

Austrian woven plastic packaging and PET recycling machinery supplier Starlinger & Co. GmbH announced its India foray in a low-key manner. "After four decades Starlinger is back in the Indian market stronger than ever with a production unit in Gujarat and with our expertise in sustainable packaging solutions in a partnership with our Indian partner Technology Plastomech Pvt Ltd.," the company said in a statement.

According to a report prepared by the show organizer Plastindia Foundation, injection molding machines dominate the Indian market with 10,000 installed in the 2021-22 fiscal year.

That represents a return to levels before the COVID-19 pandemic, which saw demand drop for two years, the report said. It added that the plastics machinery sector grew about 8.5 percent a year from 2017-18 to 2021-22.

"India's plastics processing machinery sector requires 15,000 machines annually, which includes all kinds of machines like injection molding, extrusion and blow molding," said Vinay Bansod, a PMMAI board member. "Only about 60 percent are manufactured by the companies based in India. The rest are imported."

Most of the 4,200 machines imported in the 2021-22 fiscal year, which ran from April 1 to March 31, came from China. Chinese companies are also investing in the country through joint ventures, partly in response to anti-dumping tariffs on Chinese injection presses.

The Plastindia report said India's plastic machinery market is projected to touch 19,600 machines by 2026, with demand for injection molding machines projected to reach 13,700 units a year.

Extrusion machines are projected to hit 4,700 annually in that period, with demand for blow molding machinery expected to reach 1,200 by the 2025-26 fiscal year, the report said.

For injection presses, the report projects India will remain a major market for machines in the range of 120-450 tons clamping force, with the majority of the demand coming in that segment.

The report projects that domestically made plastics machinery of all types will grow from 10,500 machines a year to 14,250 by the 2025-26 fiscal year.

Despite expected investments in Indian-made machinery operations, the report also said imports are expected to grow from 4,200 in 2021-22 to 5,350 machines by 2025-26.

PMMAI leaders said demand is expected to come from automotive and white goods markets, as well as Indian companies looking to upgrade their automation.

"Increasing automation and technology will drive the growth in the Indian plastic machinery sector in the next five years," said Shirish Divgi, a PMMAI board member and former managing director of the India factory for Milacron Holdings Corp.

Currently, 75-80 percent of the demand for injection machines comes from 450 tons and under.

But it's expected that demand for higher tonnage machines will grow because of investments in the automobile and white goods sectors. Several injection press makers said at the show they're investing in new capacity for higher tonnage machines.

"The automobile sector is ramping up their production capacities to cut the long waiting period, and demand for higher tonnage injection molding machines of between 500 and 3,000-plus tons is expected to maintain a positive trend," Bansod said.

Lifestyle preferences are also impacting demand for higher tonnage machines needed to make white goods like refrigerators, while the report said pharmaceuticals, packaging and construction are also driving demand.

Bansod pointed to increasing demand for all-electric machines in the smaller tonnage ranges.

"The trend is towards all-electric injection molding machines in the up 400 tons category, as beyond 400 tons the [all-electric] machines are 3 times more expensive," he said.

Do you have an opinion about this story? Do you have some thoughts you'd like to share with our readers? Plastics News would love to hear from you. Email your letter to Editor at [email protected]

Please enter a valid email address.

Please enter your email address.

Please select at least one newsletter to subscribe.

Staying current is easy with Plastics News delivered straight to your inbox, free of charge.

Plastics News covers the business of the global plastics industry. We report news, gather data and deliver timely information that provides our readers with a competitive advantage.

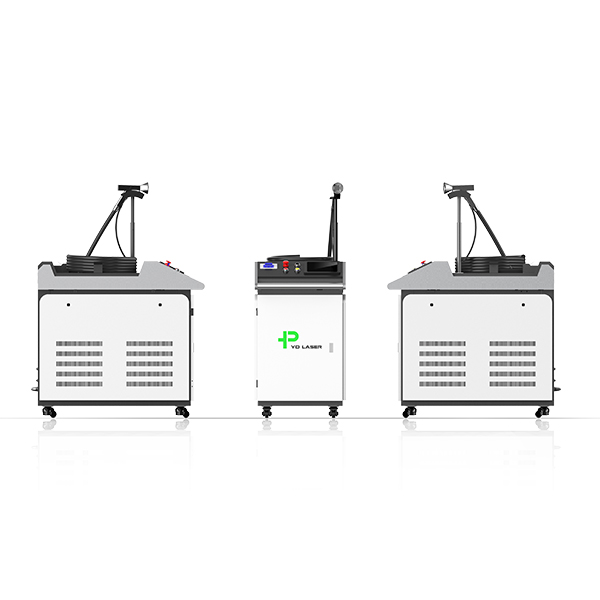

Stainless Steel Tube Laser Cutting Machine 1155 Gratiot Avenue Detroit MI 48207-2997